In late 2018, the U.S. Food and Drug Administration (FDA) sent Galt Pharmaceuticals LLC a type of letter no one wants to receive.

The FDA issued Galt Pharmaceuticals an untitled letter, a type of “warning letter” used to notify companies of a specific regulatory violation, such as poor manufacturing practices, problems with claims for what a product can do or incorrect directions for use.

The untitled letter delivered to Galt Pharmaceuticals was sent regarding its insomnia product, DORAL. The FDA alleged the company intentionally sent an email to doctors that made false or misleading claims related to the drug. The FDA said these claims were “extremely concerning from a public health perspective.” The claims minimize the risks of abuse and dependence associated with DORAL and suggest that the scheduled drug is superior in safety to other prescription and over-the-counter (OTC) products, according to the FDA’s Office of Prescription Drug Promotion (OPDP). Further, the OPDP said the letter Galt Pharmaceuticals sent included the benefits of the drug but omits serious drug risks.

In recent years, warning letters like these have been issued more frequently by the FDA. The FDA issued nine total letters in 2019, up from seven in 2018 and five in 2017. The letters are sent whenever pharmaceutical companies fail to follow quality system regulations that relate to methods used to design, manufacture, package, label, store, promote, sell, install and service drugs and devices.

“Clinical holds” are another corrective action the FDA leverages to ensure regulations are met during the clinical trial phase. The FDA defines a clinical hold as an order issued to the sponsor to delay a proposed clinical investigation or to suspend an ongoing investigation. Similar to untitled letters, clinical holds can cause significant financial damages when delays are introduced to the drug approval process.

Failing to comply with FDA warning letters may lead to severe repercussions such as product seizures, withholding of regulatory approvals and in some cases civil penalties. Warning letters may also be admitted as evidence in a product liability case. Additionally, clinical holds can also open up drug companies to significant financial losses in the form of business interruption, product recalls and much more.

As the FDA continues to deploy untitled letters and clinical holds, it has become imperative that pharmaceutical companies consider the impact on potential liability and liability insurance policies used by most insurance companies serving the life science industry. With this knowledge, they can better understand their liability in these situations and how to properly leverage their insurance coverage to stay protected.

Legal Consequences of Warning Letters or a Clinical Hold

A warning letter or clinical hold may have certain unintended consequences for a drug or biological manufacturer. It may trigger action by plaintiff law firms that believe the underlying problem illuminated by the clinical hold or by pending enforcement action may suggest a company’s negligent actions or explain an increase in adverse events or injuries resulting from the product, product claims/representations or services cited in the warning letter.

In fact, FDA warning letters could support a product liability lawsuit against the life science manufacturer. At minimum, FDA warning letters may be introduced as evidence in a product liability lawsuit. Since warning letters and clinical hold decisions are publicly available, the plaintiff attorney involved in civil litigation against the recipient of the FDA action may cite this information as evidence of a life science company’s alleged failure to comply with federal regulations and therefore as evidence of its knowledge of a product design, manufacturing defect or failure to warn. It is entirely likely for a plaintiff attorney to attempt to use the warning letters to establish a pattern of negligence. Or, they could be used to establish that the life science company or its investigators were reckless and/or knew about a particular risk or product defect based on the information contained in the warning letter or resulting from the clinical hold.

Insurance Implications

Most life science companies purchase claims-made product liability policies that provide certain insurance for bodily injury or property damage arising from an event or occurrence (defined by many insurers as “an accident, including continuous or repeated exposure to substantially the same general harmful conditions”) or circumstances (defined by many insurers as “fact(s) established by direct evidence” that “would reasonably be expected to result in any claim or suit”) that may give rise to a claim. Such policies apply to claims that occur during the policy period and typically are made against the company during the policy term, regardless of when the claim is reported to the insurance carrier.

Product liability claims can be complex, particularly for life sciences companies. Months or even years can elapse between an injury, the company’s awareness of that injury and a product liability claim or suit. Understanding how product liability insurance factors into a potential claim or suit involving a person (or persons) exposed to an event is essential to ensuring the correct policy period is triggered.

It is equally important to consider how an incident would be affected if a company changes insurers while the circumstance evolves or claims come in. What’s more, it’s necessary to consider whether the policy allows for an adequate time period to report such circumstances or claims. Claims-made policies typically won’t cover a claim before the retroactive date of the policy or after its basic reporting period at expiration unless a supplemental reporting extension endorsement is purchased.

The next insurer also may not respond to claims prior to the inception date of the replacement policy, particularly if it’s a situation where the company knew or should have known of a circumstance that might give rise to a claim or suit “deemed” to have occurred in that policy period. Such knowledge might be established in an instance where a clinical hold or warning letter was received by the company and later connected to a claim or suit.

In practice, companies may overlook a clinical hold event and not think of it as a reportable issue under its liability insurance policies until it’s too late. This may happen when a claim presents in the future and the insurance company denies coverage since the clinical hold occurred during a previous policy period, was unreported or noticed, and proper disclosure was not made to secure coverage for the next policy period.

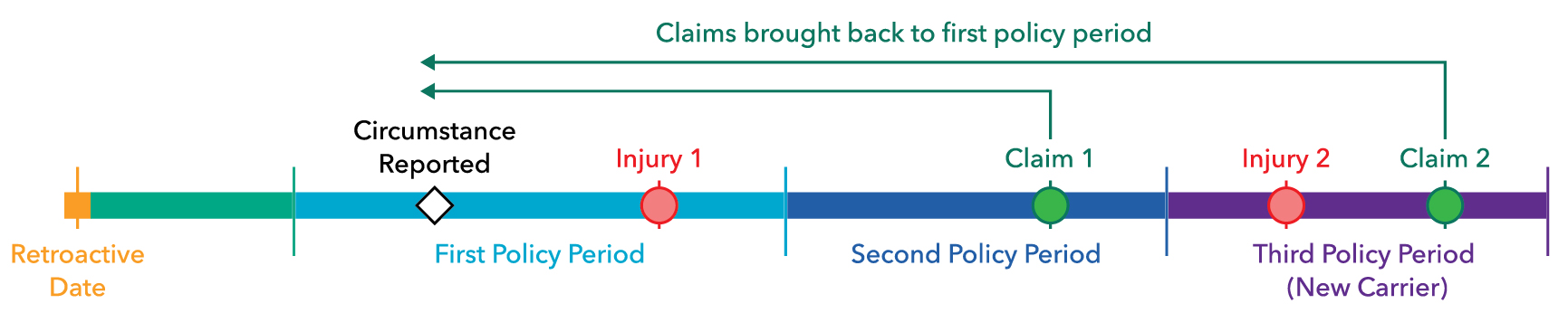

The graphic below illustrates how important timing is to the resolution of a claim under a claims-made policy:

Claim 1: This claim would not be insured in the second policy period since the circumstance was reported in the first policy period. Since the facts of the claim in the second policy period connect it with the reported circumstance, the claim would telescope back to the first policy period, if no other insurance is available.

Claim 2: The coverage is moved to a new insurance company. A report is made before the end of the first policy period but the claim doesn’t materialize within the basic reporting period under the expiring policy. However, a supplemental reporting period is purchased providing enough time for a claim to be made for injury two and the facts of the claim are connected to the circumstance reported in the first policy period. In this case, the claim would be allowed since it is within the supplemental reporting period and it will be telescoped back to the first policy period where coverage was preserved when the circumstance was first reported.

Claims professionals and lawyers will uniformly suggest that a life science company report any circumstances involving an adverse event to them as soon as practicable. Providing as much detail as possible will help the insurance company determine whether the circumstance ultimately gives rise to a claim, what policy the circumstance is associated with and how that claim will telescope back to the policy in which the circumstance was first deemed known.

In general, such circumstances may involve:

Covering the Bases

As the FDA continues to send more untitled letters, life sciences companies must verse themselves in the regulatory risks they face as well as the financial and legal implications of experiencing such an event. These companies should start by working with their insurance broker to ensure their insurance coverage is sufficient.

If a company chooses to change insurance carriers, it is critical they work with their insurance broker to understand their rights under the policy for any previously reported circumstances. It’s essential to report any circumstances the company is aware of within the terms of the basic reporting period and to determine what facts to provide and how much time the new policy affords to report known circumstances. In addition, your broker will help you determine whether it would be wise to purchase a supplemental reporting endorsement to afford adequate time for such circumstances to be recognized as claims under their expiring policy.

Click here for a printable download.

Senior Partner, National Life Science & Technology Practice Leader